“We knew it was about $1,000 an evening for a daily hospital mattress, however when he was moved to the ICU … we came upon it may very well be wherever between $7,000 and $10,000 a day.”

Article content material

What ought to have been a calming trip, reuniting with family members and the sights of southern Alberta, has changed into a nightmare for one household now going through greater than $100,000 in medical payments.

Commercial 2

Article content material

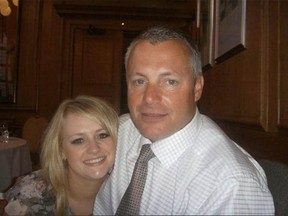

David Verlander, of Blackburn, England, hopped on a flight to Calgary together with his son, Max, on Dec. 21 to go to his daughter, Hollie, with whom he hadn’t spent Christmas in almost a decade.

Article content material

Hollie booked the pair’s flights on her bank card, assuming that the journey insurance coverage she had by means of her card would apply to the passengers. She assured her father earlier than he left that she had taken care of his insurance coverage.

Earlier than he left, David was getting over a chest chilly however visited a health care provider in England who mentioned he was high-quality to fly, Hollie mentioned from her house in Calgary.

“About six hours into the flight, my dad was having bother respiration and wasn’t feeling very effectively,” Hollie mentioned. “They acquired a nurse on board who suggested him to have oxygen, and when the flight lastly landed, EMS acquired on board and took my dad and my brother off first.”

Commercial 3

Article content material

EMTs advised David he might go to Hollie’s home so long as he noticed a health care provider the subsequent day.

Not lined by daughter’s insurance coverage

After seeing a health care provider on December 22, David was prescribed antibiotics for a chest an infection and commenced to really feel higher. Hollie known as her bank card firm to inquire about the price of the treatment and physician’s go to, and came upon her father was not lined by her insurance coverage plan.

“Clearly I felt sick to my abdomen however simply hoped that with the treatment he would get higher and that may be it,” she mentioned.

However on Christmas morning, David’s well being declined.

“We acquired up within the morning and tried to do presents, however he was very sick and mentioned he needed to go to the emergency room. . . he was admitted immediately,” mentioned Hollie.

Commercial 4

Article content material

‘He cannot breathe on his personal’

Docs ran a number of checks and put David on oxygen and ache treatment as they labored to find out what was responsible for his signs.

Hollie and Max went again house to get some sleep and obtained a name from medical doctors that night.

“(They mentioned), ‘We took him to the ICU as a result of he cannot breathe on his personal. . . Now we have accomplished the CT scan and we’re simply ready for some additional outcomes. Nevertheless it appears rather more severe than we initially thought,” she mentioned.

David’s situation has not modified a lot within the final 10 days; he’s nonetheless on a ventilator and has been identified with viral flu and streptococcus pneumonia. The treatment he was given put stress on his kidneys and he’s additionally now on dialysis.

Commercial 5

Article content material

Hospital prices are skyrocketing

Hollie mentioned that whereas her father’s well being is their household’s first precedence, the prices skyrocket day by day he spends within the hospital.

“We knew it was about $1,000 an evening for a daily hospital mattress, however when he was moved to the ICU . . . we came upon it may very well be wherever between $7,000 and $10,000 a day. So we’re already about $100,000,” she mentioned.

The household started fundraising nearly instantly to cowl a number of the prices of David’s medical payments, beginning a GoFundMe marketing campaign, internet hosting a silent public sale web site and promoting baked items in England. As of Wednesday 2 p.m., the GoFundMe had raised almost $40,000.

“Now we have to attempt to get forward of it as greatest we are able to, so we began the GoFund Me and began sharing the story and spreading some consciousness, to a minimum of attempt to educate individuals to have a look at what they’re pondering they find out about their insurance coverage or their bank cards.”

Commercial 6

Article content material

Journey insurance coverage by means of bank cards will be difficult

Lesley Keyter, proprietor of journey company The Journey Girl in Calgary, mentioned she sympathizes with the Verlander household as a result of the phrases of journey insurance coverage by means of a bank card will be difficult.

Whereas many bank card insurance policy could appear all-inclusive, Keyter mentioned many do not cowl medical bills in any respect.

“In your insurance coverage, particularly the medical cowl, you wish to be sure you know what the utmost quantity is. (Some insurance policies) provide wherever from $5 million to $10 million simply in medical protection. So, in fact, there’s a realization that these prices can go up,” she mentioned. “Additionally see if there’s any type of deductible.”

Hollie mentioned she and her household stay hopeful that her father will make a full restoration.

“From the entire household, we simply wish to thank the group of Calgary, in addition to the assist from England, as a result of no person right here is aware of my dad, however the quantity of assist that has come by means of has simply been completely unbelievable.”

ocondon@postmedia.com