Article content material

Excessive oil costs and bitterly chilly climate needs to be the proper recipe to strengthen pure gasoline markets in Canada this winter.

Commercial 2

Article content material

As a substitute, Alberta gasoline costs took an enormous tumble within the opening weeks of 2023, flattening together with U.S. markets.

Article content material

Earlier this week, US benchmark costs briefly fell beneath US$2 per million British thermal items (mmBTU), down greater than 75 p.c from final summer season’s highs.

Costs are additionally in a funk in Western Canada, even with a deep freeze that descended on the Prairies this week, forcing furnaces into overdrive.

“This winter chilly blast we’re getting is simply too little, too late,” mentioned Jean-Paul (JP) Lachance, CEO of Peyto Exploration & Growth, one in every of Canada’s largest gasoline producers.

“For gasoline costs to actually take off right here, you want this climate in Chicago, not Calgary,” added Sadiq Lalani, CFO of Kelt Exploration.

Commercial 3

Article content material

“I do not assume anybody predicted that gasoline can be beneath $3. It is positively a little bit of a shock.”

The beginning of 2023 has been a vertigo-inducing interval for Canadian gasoline producers, who loved a powerful restoration in ’22 after a number of powerful years.

Drilling exercise and manufacturing rose over the previous 12 months as exports of liquefied pure gasoline (LNG) from the US rose to fulfill the wants of nations in Europe and Asia, pushing up costs in North America.

Final 12 months, benchmark AECO pure gasoline costs in Alberta averaged C$5.31 per thousand cubic toes (mcf), up greater than 40 p.c from 2021 ranges, and producers responded by growing spending to carry on further provides.

Nevertheless, the primary two months of 2023 reversed the script.

Commercial 4

Article content material

Hotter than anticipated winter climate in elements of the US and an outage on the huge Freeport LNG terminal in Texas – which accounting for 17 p.c of all US LNG export capability — has side-swept gasoline markets, pushing costs decrease.

The interruption of exports from Freeport LNG, which solely this week bought approval from US regulators to renew operations after a hearth final June, meant that about two billion cubic toes (bcf) per day of gasoline didn’t depart the continent.

On Thursday, US gasoline costs closed at $2.35 per mmBTU on the New York Mercantile Alternate (NYMEX).

“This can be a full swing of the pendulum from what we noticed in 2022,” mentioned analyst Jeremy McCrea of Raymond James.

“It is nothing wanting outstanding how shortly and shortly pure gasoline costs have taken off right here.”

Commercial 5

Article content material

McCrea identified that manufacturing rose to 18.1 bcf per day in Western Canada final week, up 9 p.c from a 12 months earlier, with further provides arriving as costs have fallen this 12 months.

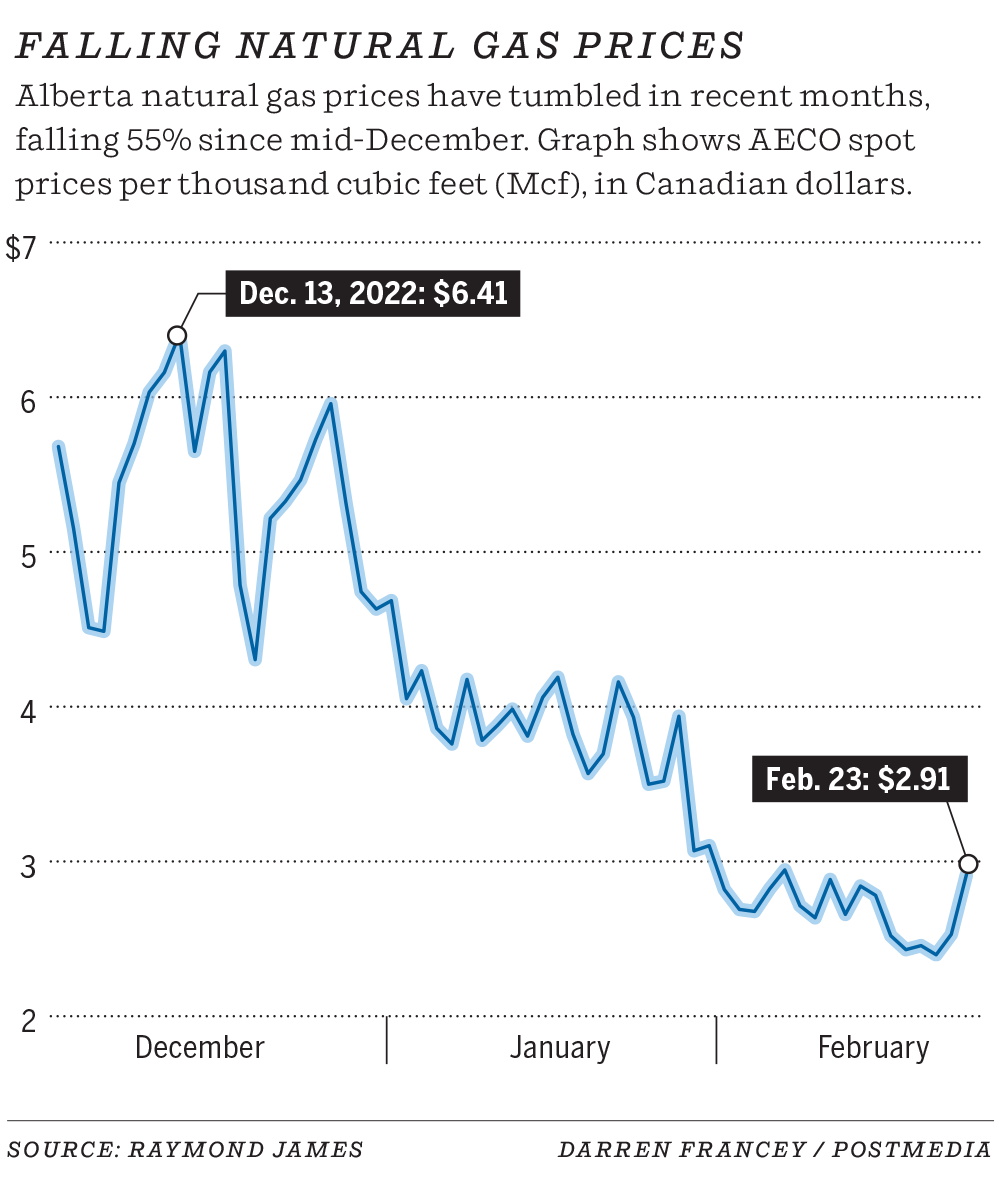

Again on December 13, 2022, AECO pure gasoline spot costs closed at C$6.40 per thousand cubic toes (mcf), in response to Raymond James information. On Thursday, it stood at $2.91 per mcf, even with chilly climate fueling greater demand in Western Canada.

“What meaning is that we’re in all probability going to need to undergo the (worth) ache by way of the remainder of the winter and doubtless the summer season as nicely,” mentioned Lalani.

“However what meaning is that the rig counts within the U.S. have to start out happening for gasoline drilling.”

Early indications are that that is already taking place south of the border.

Commercial 6

Article content material

Baker Hughes reported on Friday that the rig depend within the US fell by seven to 760 lively rigs, the largest decline in additional than two years.

Jonathan Snyder, vp of vitality analytics firm Enverus, mentioned warmer-than-expected climate to start out 2023 and extra gasoline being saved within the U.S. is placing “unrelenting strain” on costs.

“We anticipated weak point. We definitely didn’t count on costs to drop beneath $2,” he mentioned.

Snyder famous that U.S. producers Comstock Assets and Chesapeake Power have each just lately indicated they’ll cut back drilling within the Haynesville formation in Louisiana and Texas this 12 months on account of weak gasoline costs.

Earlier this month, the US Power Data Administration minimize its worth outlook for Henry Hub pure gasoline costs by 30 p.c to US$3.40 per mmBTU.

Commercial 7

Article content material

Analysts say low costs within the US are additionally prone to imply continued distress in Western Canada, given the interconnection between the markets.

“In our view, the U.S. market goes to be oversupplied, actually till the top of 2024,” Snyder mentioned.

“Possible pushed by the depressed NYMEX worth, we do not actually see costs returning to 2022 ranges for AECO any time quickly.”

-

Varcoe: Throughout grid warnings, pure gasoline powers Alberta

-

Varcoe: Will Canada reply allies’ name for LNG – ‘it is a TBD’

In Western Canada, most firms will not be but scaling again spending plans for the 12 months as producers have already locked of their packages for the winter drilling season.

The Canadian Affiliation of Power Contractors experiences 84 rigs drilled for pure gasoline final week, up 15 p.c from the identical interval final 12 months.

Commercial 8

Article content material

Nevertheless, that development might change within the spring and summer season if low costs persist, and as favorable hedges that included greater costs for producers start to come back off.

“We have not seen an enormous response but, but when gasoline costs proceed, you may see some capital budgets being minimize,” Lalani added.

“Individuals will in all probability rethink in April and Might.”

Though Peyto is just not uncovered to AECO gasoline costs, Lachance expects weak costs in Alberta to proceed by way of the summer season, a risky interval for the market as it’s usually affected by upkeep work on the pipeline system.

Peyto, which has set a capital funds of $425 million to $475 million for the 12 months, will stay versatile and spend on the decrease finish of its goal.

“We will take a cautious method to our capital program,” Lachance mentioned.

“And we’ll preserve a detailed eye on costs.”

Chris Varcoe is a Calgary Herald columnist.

cvarcoe@postmedia.com

Commentary

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourages all readers to share their opinions on our articles. Feedback might take as much as an hour to look on the location. We ask that you simply preserve your feedback related and respectful. We have enabled e-mail notifications—you will now obtain an e-mail whenever you obtain a reply to your remark, there’s an replace to a remark thread you observe, or when a consumer you observe feedback. Go to our Group Tips for extra data and particulars on the best way to regulate your e-mail settings.

Be a part of the dialog