Central financial institution’s personal surveys counsel policymakers might want extra time, says economist

Article content material

Only a week earlier than the Financial institution of Canada decides on rates of interest new proof has some economists questioning their forecasts on the primary lower — and this time it comes from the central financial institution itself.

Article content material

Inflation expectations within the Financial institution of Canada’s enterprise and client outlook surveys yesterday confirmed enchancment, however they’re nonetheless excessive, elevating the likelihood that the coverage makers could wait till the following survey earlier than making a transfer, mentioned Stephen Brown, Capital Economics Ltd.’s deputy chief economist for North America.

Commercial 2

Article content material

That survey comes out July 15, which might imply the central financial institution must maintain its rate of interest till its July 24 assembly, which fits towards the present consensus name for a June lower.

Inflation expectations “are nonetheless too excessive and lift the danger that the financial institution will wait to see developments within the subsequent surveys in July earlier than it cuts rates of interest,” Brown mentioned in a be aware.

The survey revealed there’s work to be performed on the inflation entrance.

Whereas Canadians consider inflation has slowed, their expectations within the close to time period have barely modified, the Financial institution of Canada mentioned.

Furthermore, their expectations for long-term inflation, 5 years from now, have really elevated, with respondents believing that top authorities spending and lofty house and lease costs will take longer to resolve, the survey mentioned.

Apparently, the Canadians surveyed perceived inflation to be at 5.3 per cent, a lot larger than the precise newest studying of two.8 per cent, with 60 per cent of them saying meals costs have been an enormous a part of that notion.

Brown mentioned the latest easing of meals worth inflation could decrease these expectations within the subsequent survey, however the excessive fee of lease inflation and a rebound in fuel costs could restrict the decline.

Article content material

Commercial 3

Article content material

“On the margin a minimum of, the quarterly surveys could persuade the financial institution that there isn’t any rush to loosen coverage,” he mentioned.

Capital nonetheless maintains its forecast of a June lower, however mentioned “the dangers are tilted towards a barely later lower.”

There was progress on how companies understand inflation with the share of firms anticipating the patron worth index to be above three per cent over the following yr falling to 40 per cent from 54 per cent, however that’s nonetheless above pre-pandemic ranges.

“The bettering tendencies might be welcomed by policymakers, however aren’t sufficient to immediate fee cuts simply but,” Benjamin Reitzes, a strategist on the Financial institution of Montreal, mentioned. “A June ease stays in play, however we’ll must see the following couple of CPI prints register an additional slowing in inflation.”

The survey is the second indicator in only a few days that has solid shade on hopes for a June fee lower.

Knowledge out final week confirmed that Canada’s financial system had grown quicker than anticipated within the first two months of the yr, beating the Financial institution of Canada’s personal forecasts.

Marc Ercolao, an economist at Toronto Dominion Financial institution, mentioned the “strong” figures current a troublesome problem for the central financial institution.

Commercial 4

Article content material

“Market pricing remains to be hopeful of a primary rate of interest lower occurring in June, although we predict a July lower is extra probably,” he mentioned in a be aware.

We get two extra information releases this week earlier than the Financial institution decides on April 10 — worldwide merchandise commerce and the roles report Friday — however economists should not anticipating to see a game-changing downturn in both.

“At this level, we’re clinging to our name of 4 fee cuts, starting on the June assembly,” BMO chief economist Douglas Porter mentioned after gross home product information got here out final week.

“However suffice it to say that if subsequent week’s information echoes the strong GDP outcomes, the principle message within the April 10 choice and MPR could be ‘what’s the push?’”

Enroll right here to get Posthaste delivered straight to your inbox.

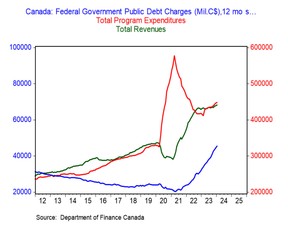

With the federal price range simply two weeks away, Ottawa might be challenged to fulfill its most up-to-date deficit estimate of $40 billion, says BMO chief economist Douglas Porter, who brings us at this time’s chart.

Revenues are up 3 per cent yr up to now and program spending is up 6.7 per cent, which is roughly according to earlier than the pandemic.

Commercial 5

Article content material

Nevertheless, the “X-factor,” says Porter, is the large enhance in curiosity expenses, that are up greater than $20 billion from 4 years in the past.

The economist mentioned these prices will solely climb larger over the following yr with the addition of extra debt and the rollover of low-rate debt.

- Prime Minister Justin Trudeau will make a housing announcement upfront of the 2024 federal price range

- Manitoba price range

- Vancouver properties gross sales for March

- At this time’s Knowledge: United States manufacturing facility and sturdy items orders

- Earnings: Paychex Inc

A pair are making ready to start out drawing from their financial savings as their important supply of earnings, however should not positive tips on how to greatest put their registered retirement financial savings plans to work for them. We requested monetary planner Graeme Egan to assist them out.

Advisable from Editorial

-

Canada may pull off that elusive ‘tender touchdown’

-

Canadian greenback might be in for a bumpy experience

Are you fearful about having sufficient for retirement? Do it is advisable alter your portfolio? Are you questioning tips on how to make ends meet? Drop us a line at aholloway@postmedia.com together with your contact information and the overall gist of your downside and we’ll attempt to discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, in fact). If in case you have a less complicated query, the crack group at FP Solutions led by Julie Cazzin or one in every of our columnists can provide it a shot.

Commercial 6

Article content material

McLister on Mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column might help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t wish to miss. Learn them right here

At this time’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material