Recession will deliver Financial institution of Canada rate of interest cuts this spring, Desjardins says

Article content material

Canada might not be in a recession proper now, however it’s prone to enter one very quickly and that may immediate the Financial institution of Canada to chop rates of interest, economists at Desjardins Group say.

Article content material

A recession is anticipated to hit within the first half of 2024 as the total power of upper charges weigh on the economic system, in line with a Jan. 22 notice by Desjardins economists Jimmy Jean and Randall Bartlett.

Commercial 2

Article content material

The consequences of a slowdown will broadly dampen financial exercise, the economists stated. Canadians can anticipate declines in funding and exports — introduced on partially by a weakening United States economic system — together with an increase within the unemployment fee. Shoppers attempting to make costlier mortgage funds in a high-interest fee surroundings are additionally seen curbing spending, squeezing the economic system much more. Added collectively, that may push the nation into recession.

Rate of interest cuts will comply with shortly thereafter. “Together with the pattern decline in inflation, this could immediate fee cuts, doubtless beginning this spring in Canada,” Desjardins stated.

However a recession provides no purpose to panic: the downturn is prone to be short-lived and gentle. “We don’t see causes to be overly pessimistic about what is going on,” Jean and Bartlett stated. And even within the off likelihood issues do take a flip for the more serious, the Financial institution of Canada will in a position to step in, they stated.

Canada’s economic system weakened over 2023, however maybe not sufficient to be coined a recession. The C.D. Howe Institute, which has change into Canada’s unofficial decide figuring out recession durations, defines the time period as a “pronounced, persistent and pervasive decline in financial exercise.” The nation doesn’t appear to have met that standards by the top of the third quarter, Desjardins stated.

Article content material

Commercial 3

Article content material

For one factor, gross home product was revised upward within the second quarter and the economists assume one other upward revision to GDP is feasible for Q3. (GDP fell 1.1 per cent yr over yr within the third quarter, Statistics Canada reported.) On the similar time, different financial information has been blended, although it’s principally trending into weaker territory. Taken collectively, there’s an opportunity GDP could have grown barely within the fourth quarter, the economists stated, lacking the definition of a recession.

Many economists have been forecasting a robust financial downturn for greater than a yr now. Desjardins made its first recession name in the midst of 2022, for instance. However the downturn was finally delayed amid tailwinds from robust inhabitants development, which helped increase shopper spending. Now, the inflow in newcomers is anticipated to sluggish, and that, mixed with the consequences of excessive rates of interest on different elements of the economic system, factors to a brief and shallow recession early this yr.

Nonetheless, it may take a while earlier than consultants render a recession verdict, the economists wrote.

Commercial 4

Article content material

“This isn’t the pandemic when issues had been screaming apparent, however relatively a really complicated and extremely uncommon set of dynamics, enjoying out in a contest of remarkable uncertainty,” Jean and Bartlett stated. “Confidently making a judgment will warrant cautious consideration.”

Join right here to get Posthaste delivered straight to your inbox.

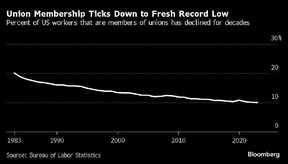

Union membership in the US continued a decades-long slide to a report low in 2023, at the same time as unions capitalized on high-profile talks with automakers and actors and gained the most important raises in years.

The union membership fee — the share of wage and wage staff who had been members of unions — was 10 per cent final yr, slightly below the ten.1 per cent seen in 2022, in line with Bureau of Labor Statistics information launched Jan. 23. Bloomberg has extra.

- The Financial institution of Canada will launch its newest rate of interest resolution and publish its quarterly Financial Coverage Report at 9:45 a.m. A press convention will comply with at 10:30 a.m. that includes Financial institution of Canada governor Tiff Macklem and senior deputy governor Carolyn Rogers.

- Former Fox Information anchor Tucker Carlson will converse on the Telus Conference Centre in Calgary, and have a dialog with Alberta Premier Danielle Smith.

- Patricia Kosseim, Data and Privateness Commissioner of Ontario, will host a panel dialogue in Toronto in regards to the adoption of synthetic intelligence applied sciences within the public sector, with privateness consultants from the general public sector, academia and advocacy teams.

- Earnings: Tesla Inc., Worldwide Enterprise Machines Corp.

Commercial 5

Article content material

Get all of right this moment’s high breaking tales as they occur with the Monetary Submit’s dwell information weblog, highlighting the enterprise headlines you should know at a look.

Really helpful from Editorial

-

Client spending is weaker than folks understand

-

Mortgage ‘cost shock’ why Canada’s economic system has fallen behind

-

Canada caught in inhabitants entice for first time in trendy historical past

A brand new yr is an effective time to determine what you should do to place your self on firmer monetary footing, whether or not that’s a retirement plan, saving for a home or large buy, or simply attempting to get forward as prices and taxes proceed to rise. Should you’re questioning what to do subsequent, drop us a line at aholloway@postmedia.com along with your contact data and the final gist of your downside and we’ll attempt to discover some consultants that can assist you out whereas writing a narrative about it (we’ll maintain your identify out of it, in fact).

At the moment’s Posthaste was written by Victoria Wells, with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material