Article content material

A 12 per cent surge in residential property values in Calgary displays a robust, rising housing market, town assessor mentioned Wednesday.

Commercial 2

Article content material

Town’s typical single residential property is now value $555,000, a 14 % improve from $485,000 final yr. The typical residential condominium is value $255,000, a 9 % year-over-year enhance.

Article content material

Robust gross sales and excessive market demand are driving these worth will increase, Metropolis Assessor Eddie Lee mentioned, and houses within the suburbs have seen an even bigger enhance in worth than these within the inside metropolis.

“From these will increase, we will see that Calgary’s property and actual property market is steady, resilient and rising. Progress in new and present communities continues to play a vital position in Calgary’s improvement,” mentioned Lee.

“What we’re seeing is a good yr for Calgary when it comes to the actual property market. We see each non-residential and residential properties typically rising in worth.”

Commercial 3

Article content material

Property values in suburban Calgary are rising

Suburban dwelling values grew by about 16 %, a considerably bigger soar over what was recorded in communities nearer to the core.

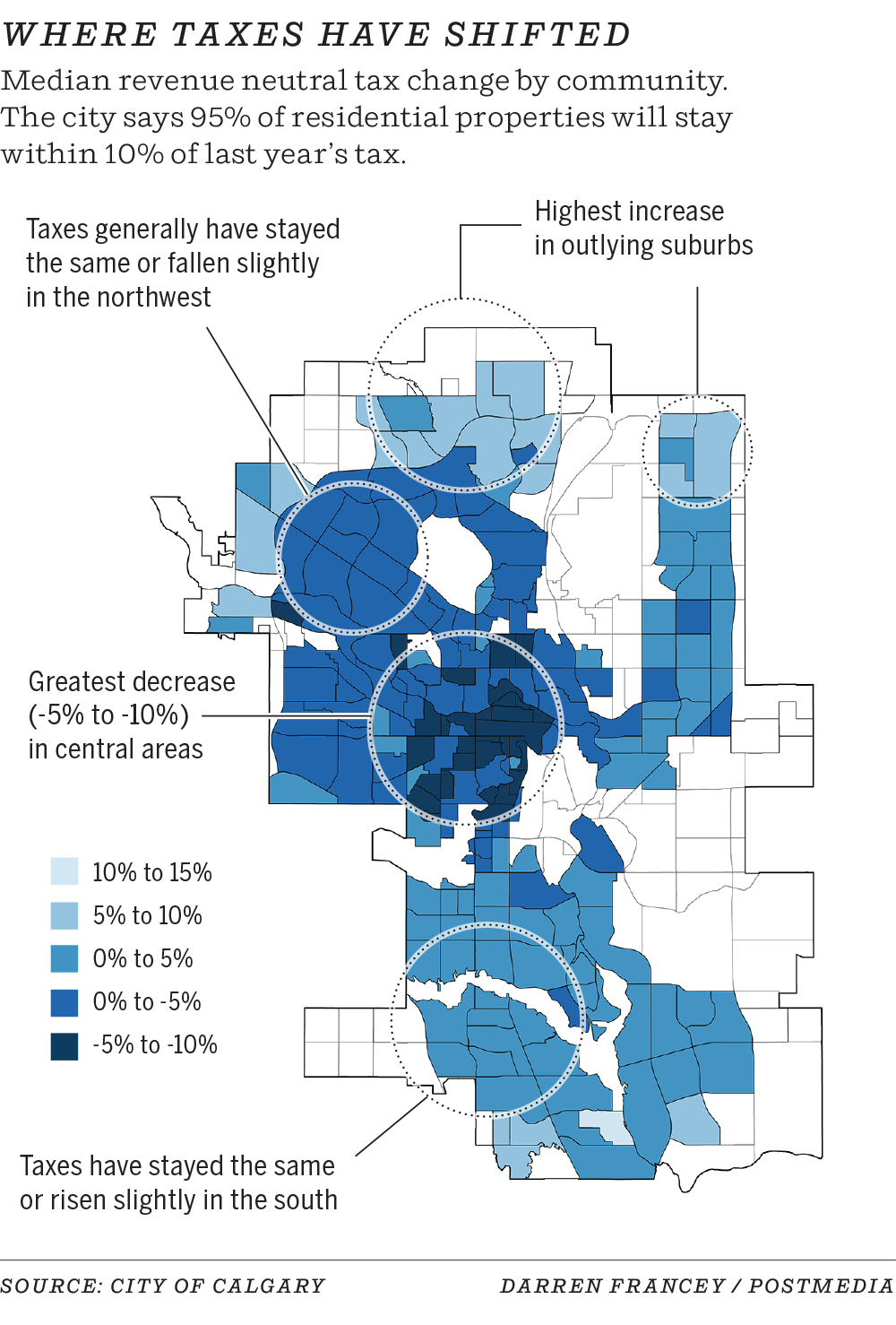

Single residential and condominium tax adjustments have been greater than 10 % in a handful of neighborhoods on town’s outer limits, together with Tuscany, Evanston, Redstone and Seton. In the meantime, that change was a 5 to 10 % lower in core communities just like the Beltline, Killarney and Tuxedo Park.

These tendencies symbolize a shift away from the core that has been accelerated by the COVID-19 pandemic, Lee mentioned.

“Persons are searching for greater homes, and normally you will discover these greater homes within the suburban communities. And with extra hybrid work and distant work, it isn’t as essential to be near town middle because it was once pre-pandemic,” he mentioned.

Commercial 4

Article content material

Town issued greater than 565,000 property assessments on Wednesday, with these notices anticipated to reach within the mail inside two weeks. A evaluate interval throughout which property house owners can ask questions on their evaluation or file complaints shall be open till March 13.

The property worth assessments are calculated based mostly on market valuations from 1 July 2022, in addition to the property’s bodily situation on the finish of the yr.

The full assessed worth of all actual property in Calgary elevated by $38.2 billion from final yr, in accordance with town. The full evaluation roll for 2022 stands at $351.7 billion.

Rebound continues after interval of contraction

These numbers symbolize a continued setback for town’s property values after a number of years of contraction; the worth of town’s evaluation roll rose by about $14 billion in 2021, the primary progress since 2018.

Commercial 5

Article content material

As assessments rise, so will property tax payments for some residential owners. These whose property values have elevated probably the most — together with suburban single-family owners — can count on to see bigger will increase, although precise numbers rely upon how dwelling values have modified. Normally, suburban residential properties will see tax will increase, whereas these within the inside metropolis will lower.

Lee mentioned the proprietor of a mean $555,000 dwelling can count on to see a few $10.50 month-to-month improve on their metropolis property tax invoice.

-

Metropolis tax situations present a window into how a lot owners might pay

-

Calgary property values battered by pandemic as metropolis points 2021 assessments

-

Metropolis’s early property evaluate encouraging for dwelling values

For residential house owners whose property values elevated by greater than 12 %, that quantity shall be greater, whereas these whose property values elevated by lower than 12 % can pay much less.

Commercial 6

Article content material

“Particular tax impacts will range by property,” he mentioned.

Town mentioned tax payments for 95 % of residential properties will stay inside 10 % of what they have been final yr.

Non-residential property values put up first rise in eight years

Elsewhere, non-residential property values rose for the primary time in eight years, reversing a downward pattern for the reason that 2015 financial downturn.

The modest acquire exhibits a two % progress in non-residential property values, following a 5 % decline final yr. Downtown workplace values grew by 4 %, and industrial and warehouse properties acquired a 5 % enhance. On the opposite facet of issues, common workplace properties fell three % in worth, with suburban workplace areas going through rising vacancies.

Commercial 7

Article content material

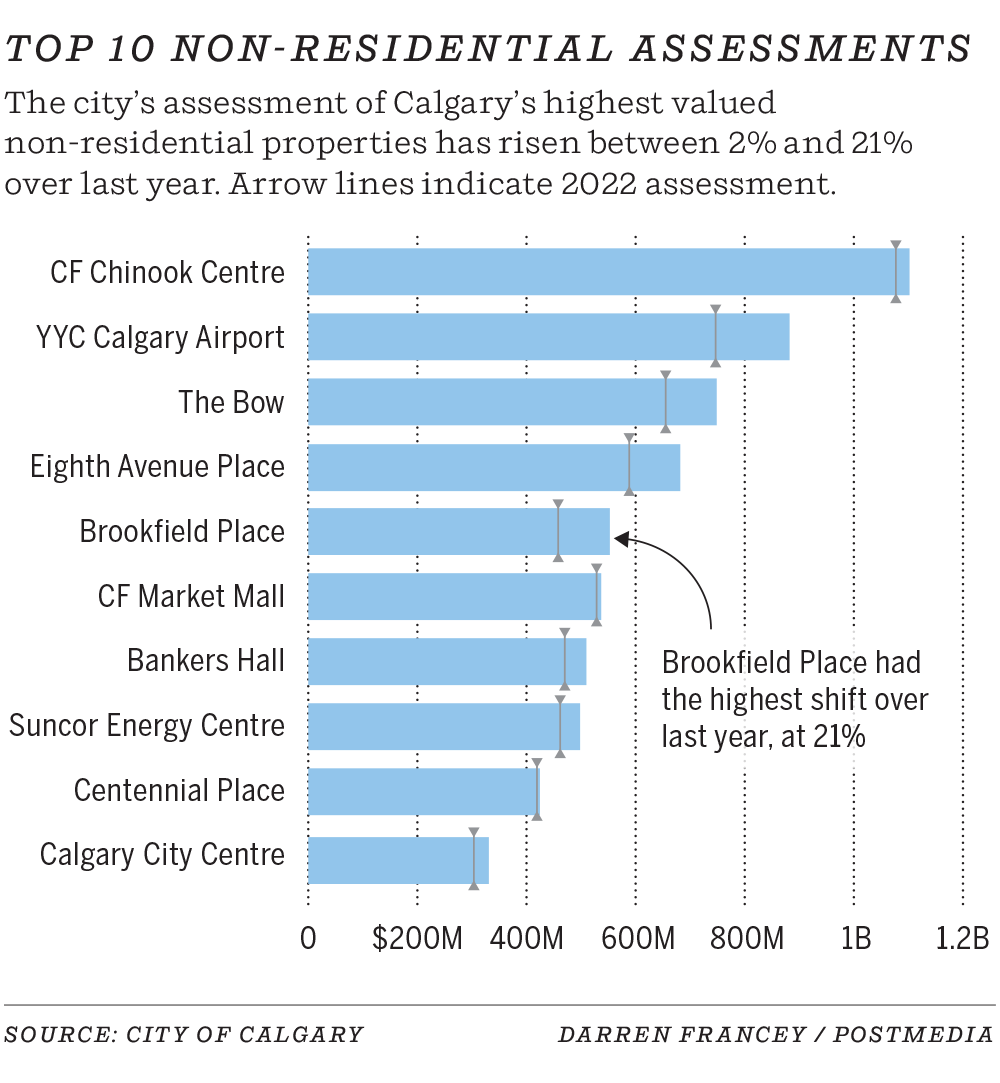

Some non-residential properties have obtained astronomical value determinations, with complete values within the tons of of thousands and thousands — and in a single case even eclipsed $1 billion.

Chinook Heart is probably the most helpful property in Calgary, valued at $1.1 billion. The airport is second at a valuation of $882 million, representing an 18 % soar from the earlier yr.

The highest 10 most respected properties are rounded out by downtown skyscrapers and complexes akin to The Bow and Brookfield Place, except for Market Mall, which is town’s sixth highest valued property.

Town declined to launch knowledge on the highest-value residential properties, citing privateness considerations.

Full property tax payments shall be despatched out in Could, following full council approval and the Alberta authorities’s spring price range launch, which is able to decide the provincial share of property taxes.

jherring@postmedia.com

Twitter: @jasonfherring