Canadians must wait a bit longer for charge reduction

Article content material

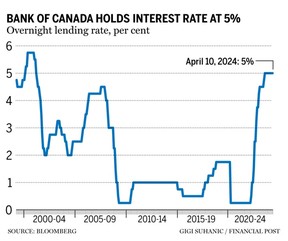

The Financial institution of Canada left the important thing in a single day rate of interest at 5 per cent Wednesday, however governor Tiff Macklem mentioned a June lower was “inside the realm of prospects.”

Macklem mentioned in a press convention after the choice that central bankers are assured within the inflation progress they’re seeing and have seen since January, together with inflation expectations and company pricing actions — however they should see it for longer to verify it’s sustained somewhat than a blip.

Commercial 2

Article content material

Article content material

Whereas the buyer worth index and core inflation have eased in current months, inflation is “nonetheless too excessive and dangers stay,” the central financial institution mentioned in an April 10 assertion, including that its governing council will watch for “proof that this downward momentum is sustained” earlier than shifting charges decrease.

“Governing Council is especially watching the evolution of core inflation, and continues to deal with the stability between demand and provide within the economic system, inflation expectations, wage development, and company pricing behaviour.”

CPI inflation slowed to 2.8 per cent in February, with easing in worth pressures changing into extra broad-based throughout items and companies.

“Nonetheless, shelter worth inflation continues to be very elevated, pushed by development in lease and mortgage curiosity prices,” the central financial institution mentioned in a press release.

Core measures of inflation, in the meantime, which had been working round 3.5 per cent, slowed to simply over three per cent in February, and 3-month annualized charges are suggesting downward momentum. The central financial institution expects CPI inflation to be shut to a few per cent in the course of the first half of this yr, transfer under 2.5 per cent within the second half, and attain the 2 per cent inflation goal in 2025.

Article content material

Commercial 3

Article content material

Andrew DiCapua, senior economist on the Canadian Chamber of Commerce, mentioned vitality worth volatility stays a wildcard for the central financial institution, regardless of a extra optimistic GDP forecast and anticipation of lowered inflation by yr’s finish.

“At their June assembly, they’ll have over three months of inflation knowledge, aided by survey outcomes trending in the correct course,” DiCapua mentioned.

When the central financial institution decision-makers met to debate final month’s coverage charge choice, they didn’t all agree on what financial indicators they would wish to see to begin reducing charges, a abstract of these deliberations revealed. Nonetheless, they did agree that the primary lower would seemingly be in 2024.

The “variety of views” included each when there would seemingly be sufficient proof to cuts charges, and easy methods to weight the dangers to the central financial institution’s financial outlook.

Economists, too, have diverse of their projections, with some anticipating the primary charge lower to come back as early as June and others predicting September because the best-case situation. Some prognosticators lately pushed their forecasts out additional because the economic system appeared in higher form than anticipated and the chance of inflation remained.

Commercial 4

Article content material

The Financial institution of Canada forecasts gross home product development of 1.5 per cent in 2024, 2.2 per cent in 2025, and 1.9 per cent in 2026 and mentioned the strengthening economic system will soak up extra provide in 2025 and 2026.

The central financial institution has revised up its forecast for world GDP development to 2.75 per cent in 2024 and about 3 per cent in 2025 and 2026.

“Inflation continues to gradual throughout most superior economies, though progress will seemingly be bumpy,” the Financial institution of Canada assertion mentioned, including that inflation charges are nonetheless projected to achieve central financial institution targets in 2025.

Advisable from Editorial

-

Financial institution of Canada holds rates of interest: Learn the official assertion

-

Canada to dodge recession, however economic system stays fragile

-

Financial institution of Canada survey finds fewer companies count on a recession

Financial institution of Canada Macklem mentioned at an earlier rate-setting announcement this yr that he doesn’t count on charges to come back down as shortly as they went up starting within the spring of 2022.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material