Insolvencies are prone to proceed to rise in 2023 because the economic system catches up with rate of interest hikes

Article content material

Insolvencies in Alberta have returned to pre-pandemic ranges after practically three years of lowered charges.

Commercial 2

Article content material

The most recent statistics present 1,402 insolvency purposes within the province in November, probably the most since March 2020 when there have been 1,492. There have been additionally 1,402 in February 2020. Enrollments fell to 1,000 in April 2020 as pandemic-related assist applications comparable to CERB started to come back on-line.

Article content material

And insolvencies are anticipated to proceed to rise in 2023.

“I feel this quantity is prone to go up even over the following few months,” mentioned Anupam Das, a professor of economics at Mount Royal College. “The economic system is slowing down. Though the principle cause why the central financial institution raised the rate of interest was to curb inflation, nonetheless, there is no such thing as a candy spot. These sorts of austerity insurance policies usually have an effect on targets and unemployment and insolvencies.”

Commercial 3

Article content material

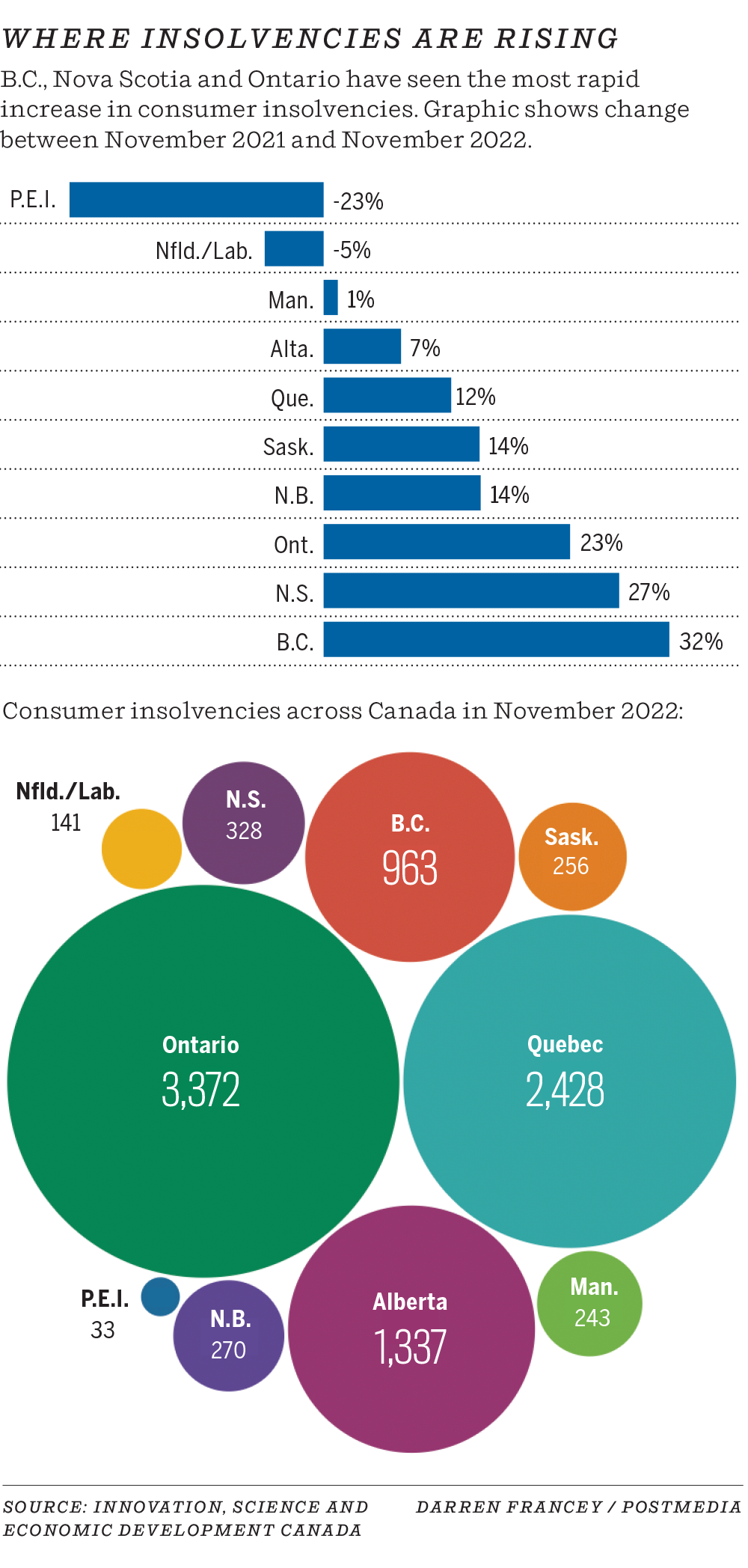

Alberta’s numbers match nationwide will increase, additionally reaching ranges not seen since March 2020. Canada-wide, there have been 9,784 insolvencies filed in November, a rise of seven.3 % month-over-month and 17.5 % year-over-month. yr. Within the final 12 months there have been 102,619 insolvencies, an increase of 10.2 per cent.

The most important proportion of all insolvencies are by customers. In Alberta, there have been 1,379 shopper insolvencies, together with 220 bankruptcies, filed in November. This is a rise of 12 % in each circumstances month-on-month, and 10.4 % year-on-year for insolvencies. Bankruptcies are literally down 15.1 % year-over-year over the 12-month timeframe.

Functions in Alberta peaked at 881 in August 2020 and fluctuated between 900 and 1,200 monthly over the following 18 months.

Commercial 4

Article content material

Whereas insolvencies have been rising for a lot of the previous yr, an enormous spike occurred in March, from 1,183 to 1,371 in Alberta, a rise of 15.9 per cent. This coincides with rampant inflation and the Financial institution of Canada beginning its collection of rate of interest hikes. Inflation continued to rise by means of the summer time earlier than flattening out over the previous couple of months of the yr, whereas the in a single day fee goal went from 0.25 % to 4.25 %.

In keeping with an Equifax report from March, Albertans had the best common shopper debt within the nation at $25,172, excluding mortgages.

Michelle Statz, a licensed insolvency trustee at Bromwhich+Smith, mentioned that they had been ready for the opposite shoe to drop within the wake of the expiry of pandemic monetary helps.

Commercial 5

Article content material

Insolvency charges had been rising earlier than the pandemic. Canada has a few of the highest ranges of shopper debt within the developed world, rising from $1.75 of debt per greenback earned in 2019 to $1.83 in 2022.

Applications like CERB and mortgage forgiveness initiatives have helped curb insolvency charges through the pandemic, however these monetary points have usually not disappeared for these struggling to make ends meet.

“As trustees, we have been speculating ever since when they are going to improve as a result of sooner or later it isn’t sustainable,” she mentioned. “Sooner or later there are going to be some sort of stressors that have an effect on that and we will see insolvencies improve.”

Statz additionally mentioned that these charges are prone to proceed to rise with an financial slowdown or recession, and instructed {that a} go to to an insolvency trustee might present customers with choices.

Commercial 6

Article content material

Das mentioned these most affected are usually probably the most weak, these already residing on the monetary edge.

In November, Premier Daniel Smith introduced plenty of measures to deal with inflation, together with the re-indexing of social assist applications comparable to AISH and the re-indexing of earnings tax ranges. Das mentioned it might assist, however solely up to a degree.

“If individuals haven’t got sufficient earnings, their taxes will probably be low to start with,” he mentioned. “I feel it is necessary that folks actually get a ample degree of earnings in order that they will handle their households, they will handle the family.”

jaldrich@postmedia.com

Twitter: @JoshAldrich03