For the primary time in eight years, the worth of workplace buildings within the metropolis’s core is growing

Article content material

It is at all times nice to interrupt a dropping streak.

Commercial 2

Article content material

The collective worth of Calgary’s downtown skyscrapers has been on a downward slide because the economic system tanked in 2015, however the lengthy, stomach-churning journey has ended.

Article content material

For the primary time in eight years, the worth of workplace buildings within the metropolis’s core, which fell by 68 p.c between 2015 and 2022, has moved modestly within the different course.

The whole assessed worth of all downtown workplace buildings elevated practically 4 per cent to $8.2 billion from the earlier yr, pushed by rising values for a few of Calgary’s high industrial properties, in response to metropolis information launched Wednesday.

“It is an excellent signal,” Metropolis Assessor Eddie Lee stated in an interview. “It exhibits that vibrancy is returning to the downtown market.”

Commercial 3

Article content material

In reality, a number of promising indicators are contained within the metropolis’s newest annual evaluation report, though issues stay.

For householders, the everyday residential property elevated in worth by 12 p.c from the earlier yr as residence costs rose in 2022. (Assessments are primarily based on a property’s market valuation as of July 1, 2022.)

Industrial properties – together with industrial, retail and workplace buildings – rose by two per cent, a marked enchancment from the 5 per cent fall within the earlier yr.

Industrial properties elevated by 5 p.c, pushed by rising demand for bigger warehouses. Retail buildings rose by 4 p.c.

-

‘Confidence is within the air’: Workplace emptiness fee exhibits greatest drop in eight years

-

Calgary residence values see 12 per cent rise in metropolis evaluation, with suburbs rising

All workplace constructions, together with these positioned exterior the core, fell by three p.c.

Commercial 4

Article content material

This makes the downtown restoration much more notable, as newer Class A and AA buildings have risen, reflecting decrease emptiness charges in these towers (in comparison with final yr) and better rental and sale costs.

“The erosion has lastly stopped,” stated Kyle Fletcher, president of Property Tax Canada at actual property analysis agency Altus Group.

“There are quite a lot of positives about Calgary proper now and a few life, particularly in the principle monetary core downtown.”

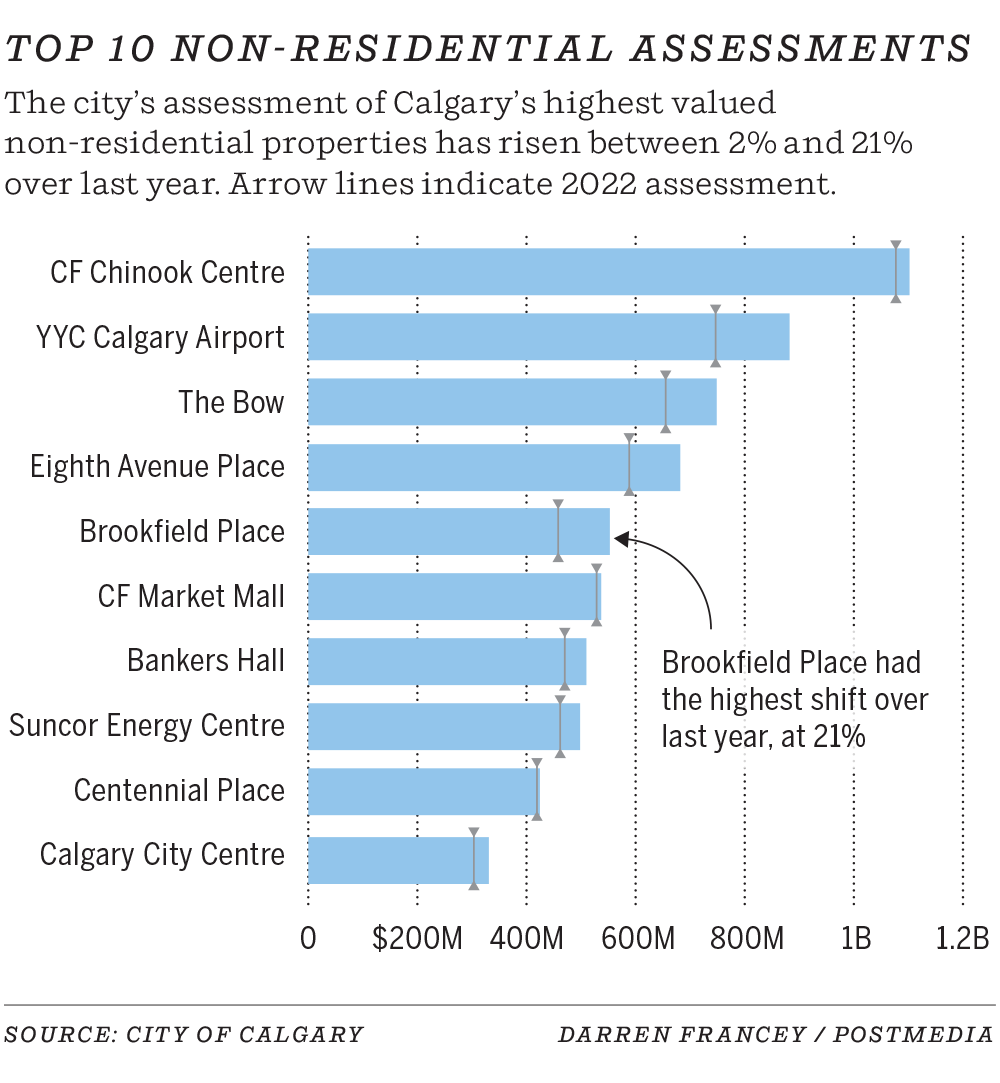

For instance, the 56th ground Brookfield Place noticed its assessed worth rise 21 p.c to $553 million, whereas Suncor Power Heart elevated eight p.c. The Bow Constructing’s worth rose 14 p.c this yr to $749 million.

Different marquee properties have additionally moved up.

Commercial 5

Article content material

Resort properties throughout Calgary, battered by extraordinarily low occupancy ranges and journey restrictions throughout the pandemic, have additionally seen a partial restoration, now up about three p.c, Lee famous.

For enterprise operators exterior the core who’ve needed to shoulder extra of the tax burden in recent times to make up for a decline in downtown values, that is useful.

Beneath town’s revenue-neutral evaluation system, which should be performed yearly, the tax burden has shifted closely in recent times to different industrial property homeowners, comparable to companies working alongside in style industrial strips and in suburban areas.

When oil costs tumbled in 2015 and native power corporations started shedding staff — and wanted much less workplace area — the assessed worth of buildings within the core hit $25 billion.

Commercial 6

Article content material

On the time, these property homeowners collectively paid $271 million in municipal taxes.

For 2023, these downtown workplaces now have a complete worth of $8.2 billion — up from $7.9 billion final yr — whereas their municipal taxes rose barely to $145 million.

This isn’t a seismic change, but it surely comes after a protracted interval of decline and one yr – 2019 – of flat workplace values within the core.

Lee famous that older Class B and C workplace buildings proceed to see their values come beneath strain resulting from restricted demand, whereas suburban workplace area can also be scuffling with rising vacancies.

Nonetheless, there have been different constructive financial modifications in recent times which have helped appraisal values, together with the return of upper commodity costs, rising employment ranges and continued diversification.

Commercial 7

Article content material

Annie Dormuth of the Canadian Federation of Unbiased Enterprise stated a deliberate tax enhance by town for 2023 will hit the underside line of small enterprise homeowners, however the general enhance in property values is promising.

“It factors to the general higher energy of the Calgary economic system,” she stated.

Town’s $100 million program to transform older workplace buildings into residential properties also needs to start to make a dent in downtown Calgary’s daunting downside of greater than 14 million sq. toes of vacant workplace area.

“As we redefine what our downtown appears like, the worth of these buildings will begin to get well as a result of there’s higher occupancy,” Mayor Jyoti Gondek stated in an interview this week.

There may be quite a lot of work to do.

Commercial 8

Article content material

On the finish of the fourth quarter, the general downtown emptiness fee stood at 32.6 p.c, in response to industrial actual property agency CBRE.

“We’re in no way within the Promised Land but, however not less than we have stopped the bleeding,” Greg Kwong stated.regional managing director for CBRE.

“Industrial property is at the moment booming. Retail is doing effectively.”

Different points additionally loom.

Balancing the tax relationship between residential and industrial properties shall be important to make sure Calgary stays aggressive sooner or later.

Distant work means fewer folks get into the core and it’s unsure precisely how this development will play out over the long run.

“All boats aren’t rising downtown, it is actually the standard, shiny new stuff that is doing loads higher,” Fletcher stated.

“I do not suppose we’re at some extent the place we will say downtown is occurring a path to take over the accountability for taxes that it had earlier than 2015.”

In different phrases, the downtown money cow is not coming again but.

Nevertheless, it appears like the times of watching Calgary’s downtown towers take it on the chin are lastly over.

Chris Varcoe is a Calgary Herald columnist.

cvarcoe@postmedia.com