The stars are set for a good 2023 for the oilfield services industry after it finally enjoyed a promising recovery this year

Article content

What follows seven years of famine? At least two years of celebration — and maybe more — for Canada’s oil and gas sector.

Advertisement 2

Article content

The stars are aligned for a bullish 2023 for the oilfield services industry after finally enjoying a promising recovery this year.

Article content

Canadian drilling levels are expected to be about 20 percent higher this year from 2021 levels.

Next year looks even stronger, despite nagging concerns about a global recession, high interest rates, red-hot inflation and a new federal emissions cap.

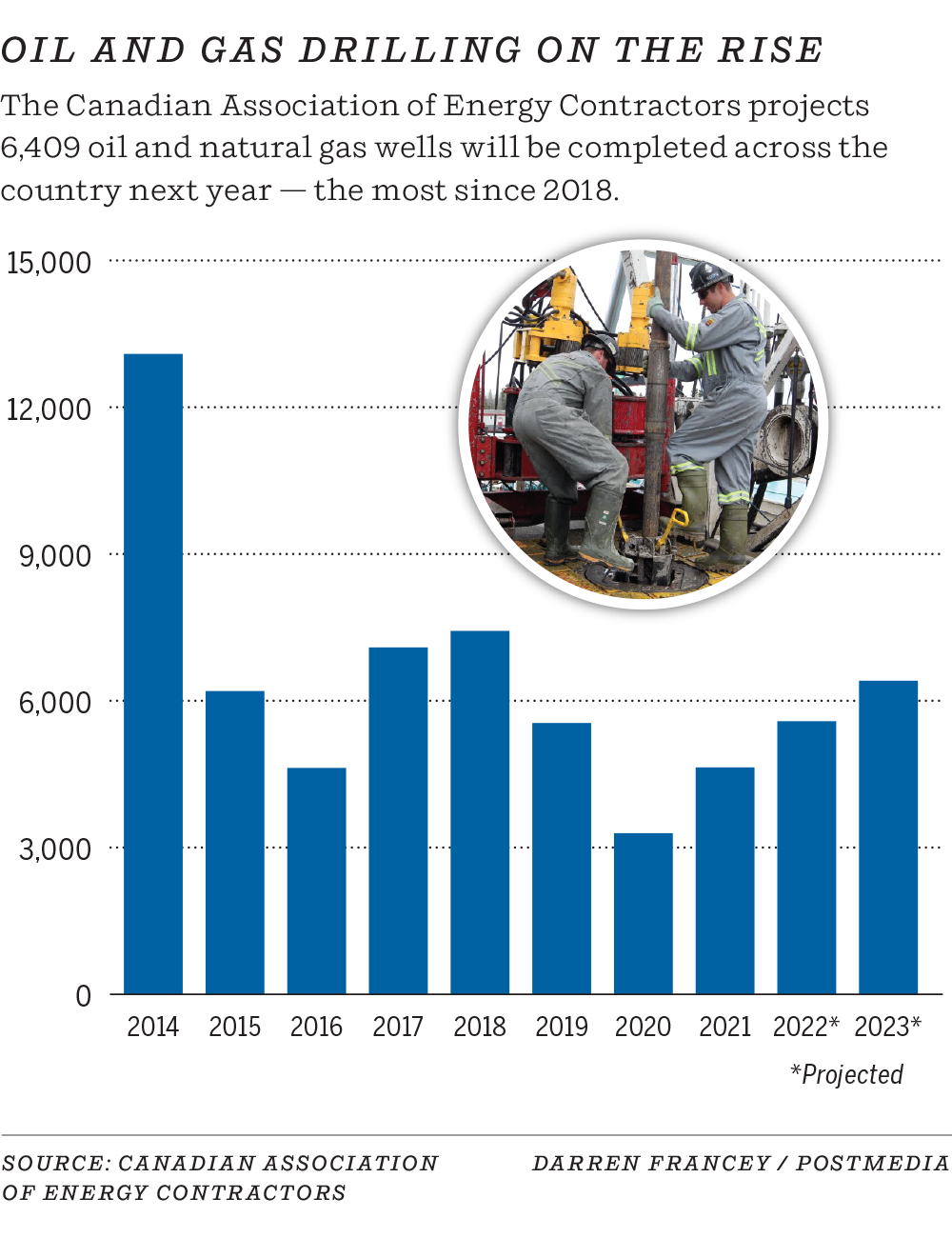

At the Canadian Association of Energy Contractors’ (CAOEC) annual outlook luncheon on Wednesday, the industry group predicted that about 6,400 oil and gas wells will be drilled next year.

This represents a 15 percent jump from 2022 levels and would be the highest number seen since 2018.

Lively commodity prices, rising profits from petroleum producers willing to spend more, and the expected completion of the long-awaited $21.4-billion expansion of the Trans Mountain pipeline – boosting export capacity from Western Canada – bolster the broader outlook.

Advertisement 3

Article content

After a seven-year downturn that began with the collapse of global oil prices last decade and culminated in the 2020 pandemic, this represents an exciting period for both petroleum producers and oilfield service firms.

“The light at the end of the tunnel, I think, is finally there. These are still volatile times. We continue to see commodity prices move up and down,” CAOEC President Mark Scholz told reporters after the event.

“I just think energy is in demand and will continue to be in demand. . . 2023 is going to be a very fragile time for the world economy. But from our perspective in our sector, we don’t see things slowing down.”

If 2023 unfolds as expected, it will be the second year of a recovery for the oil slick sector after a grueling period.

Advertisement 4

Article content

Two years ago, only 3,293 wells were drilled in Canada as energy prices fell, representing a 75 percent drop from 2014 levels.

Prices started to rise last year as demand for energy recovered. After Russia’s invasion of Ukraine in February, oil prices rose, reaching $100 a barrel this summer. West Texas Intermediate (WTI) crude oil closed at US$77.94 a barrel on Wednesday.

Gas prices have also been strong this year, with US benchmark prices trading up Wednesday at US$7.71 per million British thermal units.

Even with the discount facing Western Canadian Select heavy oil that has deepened recently and inflation heating up, the industry is posting excellent profits. Producers start spending more to grow or maintain output.

Advertisement 5

Article content

For drillers, it was a long road.

-

Canadian oilpatch expects a 15% increase in wells drilled next year

-

Varcoe: ‘Controlled whiplash’ — drillers are positive for 2022

-

Varcoe: Drillers expect return to pre-pandemic activity in ’22

Bob Geddes, president of Ensign Energy Services, said he sees producers on both sides of the Canada-U.S. border boosting capital expenditures by at least 10 to 15 percent for next year, which will lead to more jobs.

“Everything is pointing in the right direction. I am very positive about 2023,” Geddes said in an interview.

“I have been in the business since 1980 and it has always been feast or famine. . . Our third quarter was busier than our first quarter (during the winter drilling season) and I can’t remember the last time that happened.”

Advertisement 6

Article content

One of the biggest challenges the sector has faced this year has been delays in the supply chain, along with higher inflation and the limited availability of workers.

The CAOEC predicts an additional 5,437 jobs will be created next year with more drilling, up 15 percent to about 42,350 direct and indirect jobs.

In a speech to the association, Premier Danielle Smith noted that the average monthly rig count for the sector is up 75 per cent from last year and said the energy industry will continue to be at the “front end of Alberta’s economy.”

“We all know that the world economy is currently very turbulent. . . We need all levels of government to do their part to keep the sector strong,” she added. “We will go to the wall for you.”

Advertisement 7

Article content

Politics aside, there is a sense of optimism in much of Canadian industry after years of downsizing and spending less.

As Jason Jaskela, president of Headwater Exploration, said during a panel discussion at Wednesday’s event, “The last seven years have been very, very difficult and the industry is finally enjoying itself again.”

A survey last month by ATB Capital Markets of industry executives and institutional investors underlined this sentiment.

It found that about 65 percent of producers and energy service leaders expect a better outlook over the next six months.

And 85 percent of energy services executives expect more exploration and production activity from companies next year.

“One of the main takeaways from our survey was that 2023 looks like it’s going to be a growth year above 2022,” ATB analyst Tim Monachello said in a recent interview.

Advertisement 8

Article content

Expectations of high oil and gas prices in the next three to five years fuel this optimism.

Battle-tested producers have also strengthened their balance sheets and are ramping up their capital programs. However, they are also more constrained than during previous booms, significantly underspending their cash flow levels.

“I don’t think we’re going to see companies jump out and try to spend a whole lot of money because we have high commodity prices,” Birchcliff Energy CEO Jeff Tonken said.

Advantage Energy CEO Michael Belenkie pointed out that the prosperity of Western Canadian natural gas producers will depend on their ability to access pipelines and get their gas to market.

However, he agrees that expectations for 2023 are improving. The Calgary-based producer expects to increase its capital spending by nearly 10 percent next year.

“Prices support more activity,” he added. “I think there are more than seven years of prosperity for both (the oil and gas) businesses.”

Chris Varcoe is a Calgary Herald columnist.

cvarcoe@postmedia.com