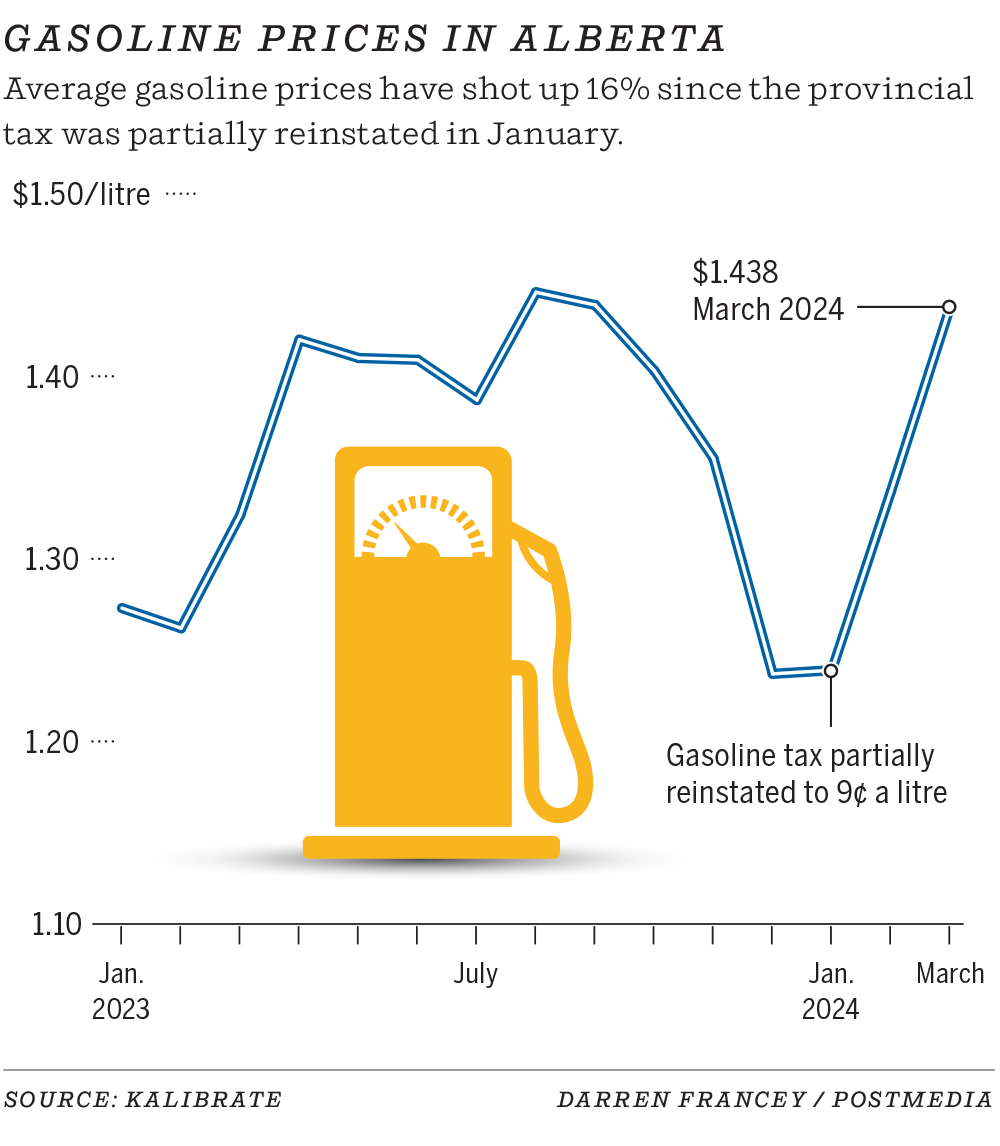

Retail gasoline costs have risen throughout the province this yr, from a median of $1.24 per litre reported in January as much as $1.44 in March, in response to analytics agency Kalibrate

Article content material

Albertans have felt elevated ache on the pumps this yr and gasoline costs are extensively projected to rev up within the coming weeks.

On April 1, gasoline costs are forecast to extend as a result of impact of federal and provincial tax will increase, whereas specialists say escalating oil costs and a number of other different market forces will possible propel charges even larger via the spring and summer season.

Commercial 2

Article content material

Article content material

“Brace for affect,” Dan McTeague, president of Canadians for Reasonably priced Power, mentioned Monday.

“I see a state of affairs right here in Alberta the place costs are up 25 cents a litre by the point we get into the total swing of the Memorial Day-Could (lengthy) weekend, as we head towards summer season.”

“I do suppose there’s fairly a little bit of room for costs to go up,” added Susan Bell, senior vice-president of downstream at Rystad Power, estimating Albertans may see a hike of about 20 cents a litre by mid-Could.

Retail gasoline costs have risen throughout the province this yr, from a median of $1.24 per litre reported in January as much as $1.44 in March, in response to analytics agency Kalibrate.

One other bump is anticipated at the beginning of April, with the provincial gas tax anticipated to return to 13 cents a litre after greater than a yr of full or partial reduction, whereas the next federal carbon tax may also be adopted.

The Alberta authorities utterly eliminated the provincial levy all through 2023, though it was partially introduced again in January to 9 cents.

Alberta’s gas tax reduction program is tethered to the worth of benchmark U.S. oil costs. The upper oil costs go, the extra income it generates for the provincial treasury — and the larger the tax break the provincial authorities provides shoppers on the pumps.

Article content material

Commercial 3

Article content material

Nevertheless, the reprieve solely kicks in if West Texas Intermediate (WTI) crude averages greater than US$80 a barrel for a 20-day interval within the earlier quarter.

The gas tax falls to 9 cents a litre if WTI crude averages between $80 and $85 a barrel. It’s set at 4.5 cents when oil averages between $85 and $90, and it’s utterly eliminated if oil is $90 or larger.

On Monday, U.S. oil costs closed at $82.16 a barrel, up $1.58 for the day.

But, it seems a latest rally gained’t be sufficient to hit the federal government’s $80-a-barrel threshold and supply assist in the April-to-June interval.

Really useful from Editorial

-

Varcoe: Alberta’s gasoline tax anticipated to leap in April, however rising oil costs could lengthen reduction

-

Jan. 2: ‘Higher than nothing’: Whilst provincial tax break fades, some gasoline offers in Calgary stay

-

Fuel tax paused in Manitoba, returns in Alberta at a decrease charge

-

Gas tax detrimental to shoppers dealing with an affordability disaster: NDP

The common worth for WTI crude for the previous 20 buying and selling days averaged simply over $78.70 a barrel, famous Martin King, RBN Power’s managing director of North American vitality market evaluation.

Commercial 4

Article content material

With WTI oil costs largely buying and selling round $78 a barrel for a lot of the previous month, that means the tax break will disappear, mentioned Vijay Muralidharan, director of R Dice Financial Consulting in Calgary.

Based mostly upon that state of affairs, the provincial tax is anticipated to leap to 13 cents a litre subsequent month from 9 cents, whereas the federal carbon tax enhance additionally kicks in on April 1, including one other three cents, he famous.

“It’s over seven cents simply in tax adjustments,” Muralidharan mentioned. “And there are greater headwinds coming.”

Ongoing refinery upkeep in North America can also be anticipated to push gasoline costs up, as will the impact of upper oil costs and seasonal points, corresponding to rising consumption through the summer season driving season.

On Monday, U.S. gasoline futures briefly reached US$2.77 a gallon, reaching its highest level in six months, in response to Bloomberg Information.

“I believe you will notice larger costs going into April and Could. I’d say I wouldn’t be stunned if it’s $1.60 to 1.65” a litre on the pumps, Muralidharan mentioned.

Suzanne Grey, a analysis analyst with Kalibrate, famous crude oil costs may enhance within the coming months as a consequence of geopolitical components and manufacturing quotas that have been lately prolonged by OPEC+ nations.

Commercial 5

Article content material

Upkeep at oil refineries through the spring and different seasonal components, such because the swap to summer-blended fuels, often provides a median of 4 cents to costs between the winter and summer season months, she mentioned in an e mail.

Information on the weekend of an unplanned pipeline shutdown in Manitoba may additionally have an effect on gas costs throughout Western Canada, as different provide is sourced.

In final month’s provincial finances, the federal government forecast that its gas tax reduction program wouldn’t kick in throughout the brand new fiscal yr. It projected oil costs will common $74 a barrel. Authorities officers say the province will replace the gas tax challenge by the tip of the month.

However Kris Sims, Alberta director of the Canadian Taxpayers Federation, identified oil costs have been under $80 a barrel final yr and the province ignored its personal formulation and supplied reduction to shoppers hit onerous by inflationary pressures.

“Immediately, we nonetheless have the identical affordability issues,” Sims mentioned.

“Timing-wise, this actually stinks. There isn’t any manner they need to be tearing a strip off Prime Minister (Justin) Trudeau for jacking up the carbon tax by three cents a litre, when they will be growing their gas tax by 4 cents.”

Commercial 6

Article content material

Oil markets have risen above $80 a barrel previously two weeks as world consumption is anticipated to climb in 2024.

Costs have been rangebound for months, however the next demand forecast for 2024 by the Worldwide Power Company final week and falling crude shares within the U.S. are pushing markets up, mentioned King.

“What the market was ready for, to a point, was form of a psychological shift in serious about demand,” he added.

Each $1-a-barrel enhance in WTI oil costs over the course of the yr pumps out a further $630 million in provincial authorities revenues.

On the flip aspect, each one cent of the provincial gas tax generates roughly $100 million in revenues, mentioned College of Calgary economist Trevor Tombe.

“The overwhelming impact of excessive oil costs on the federal government is a constructive raise in useful resource revenues,” he mentioned.

“Lengthy story quick, in the event that they do decrease gas taxes later, they are going to be in a a lot stronger fiscal place than they anticipated.”

Chris Varcoe is a Calgary Herald columnist.

cvarcoe@postmedia.com

Article content material