Write it off — or repair it? These are the alternatives on the centre of a battle between one automobile proprietor and his insurer, Allstate.

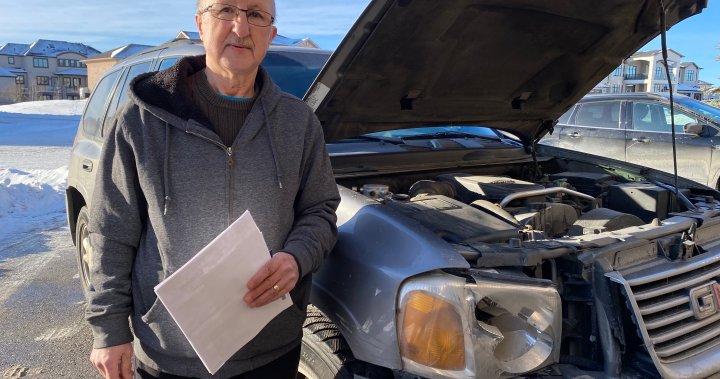

Mehmed Hujic lives within the small hamlet of Conrich, Alta. On Nov. 16, 2023, he was driving residence when a deer ran out in entrance of his automobile. The proper, entrance finish of his automobile suffered the brunt of the collision.

“Gentle, bumper, grill and washer fluid tank harm,” he advised International Information.

However Hujic identified the automobile was nonetheless drivable and, he anticipated, “fixable.” He was shocked when the insurance coverage adjuster advised him it wasn’t.

“They need to write off my automobile, I don’t need to try this,” he stated. “It’s nonetheless drivable. Transmission, engine good. It’s simply harm from deer.”

Hujic stated he was supplied an insurance coverage payout of below $5,000, which he stated considerably undervalues his automobile.

“GMC Envoy, like this one with identical 12 months, and nearly identical kilometres is $8,000 to $10,000. I pay insurance coverage firm each months (sic). No late for fee.”

Harm on automobile.

Tomasia DaSilva

International Information reached out to Allstate Insurance coverage Firm of Canada to get its response. The insurer stated its high precedence is security, including that on this specific case, “…after an intensive inspection it was decided the integrity of the body was compromised.”

Get the newest Cash 123 information.

Despatched to your electronic mail, each week.

Allstate said that was the physique store’s evaluation and the corporate’s as nicely.

It additionally added Allstate Canada is, “at present reviewing subsequent steps with the shopper, which embrace the choice to pursue repairs and entry to protection for the prices inside the phrases of their insurance coverage coverage.”

However Hujic, alongside along with his daughter-in-law, advised International Information that they haven’t been in touch. Removed from it, they stated.

“We report back to insurance coverage firm from Nov. 17,” Hujic stated. “Insurance coverage firm, they play video games with me.”

“No response,” daughter-in-law Asmira concurred. “They by no means name. I’ve left so many messages. It’s so irritating.”

“You (Allstate) must be caring for your prospects, serving to your prospects,” she added. “Repair the issue that they’ve, proper?”

When is a automobile deemed not fixable?

The Insurance coverage Bureau of Canada (IBC) advised International Information write-offs are a legitimate possibility, relying on the circumstances of the declare.

The 2 principal causes: value and security.

“If the corporate has deemed it as a write-off, it might be as a result of it doesn’t make monetary sense to restore it from the corporate perspective,” stated Anne Marie Thomas, IBC’s director of shopper and business relations.

“Sometimes, in circumstances the place the body is bent, or security options are compromised, an insurance coverage firm might say, ‘No we’re going to put in writing this automobile off as a result of it shouldn’t be on the highway.”

Thomas added the precept of insurance coverage is to place the coverage holder again into the place that they had been in, previous to the loss. Meaning the coverage holder can’t profit from any declare, she stated.

“If this automobile is price $20,000 but it surely’s going to value $25,000 to restore, then the coverage holder might be perceived as profiting,” she stated.

“An insured can’t revenue from a loss. That’s the underside line.”

IBC additionally stated drivers can attempt to negotiate with insurers to get a greater payout. She stated an association “can” occur, in the event that they (the motive force) can show to the insurance coverage firm that the provide is just too low. Some components that will come into play embrace the situation of the automobile, its mileage, and its resale worth.

Thomas added coverage holders can reject any payout and select to repair the automobile themselves, however need to beware it might be very pricey and really powerful to re-insure.

© 2024 International Information, a division of Corus Leisure Inc.