The federal government mentioned a part of the rationale for the monetary framework is because of the monumental fluctuations within the Alberta financial system and power revenues

Article content material

The Alberta authorities goes to desk the regulation on deficit budgets – it goals to cross laws to eliminate them.

Commercial 2

Article content material

A minimum of that is the message within the new provincial funds launched Tuesday by Finance Minister Travis Toews. He promised a brand new “fiscal framework” to ban annual funds deficits and cope with anticipated surpluses within the coming years.

Article content material

And the implications of ignoring the foundations?

“Look, for a authorities to violate its personal laws, and that is no matter which authorities . . . can be a public spectacle and there can be an enormous political price to bear for violating that laws,” Toews informed reporters.

“I consider that passing laws round these fiscal guidelines supplies actual tooth when it comes to the impetus for governments to observe them.”

For a lot of Albertans, this debate is a blast from the previous, going again to the Nineties and early 2000s when the Klein authorities stopped a sequence of annual deficits, lastly paid down the debt and handed balanced funds laws. It was later revoked.

Commercial 3

Article content material

Such measures can solely tie the fingers of a future authorities if they’re actually keen to observe them.

Regardless, the brand new laws is meant to “assist cope with Alberta’s distinctive financial and income volatility,” the funds doc says.

Beneath the framework, Alberta governments shall be required to have balanced budgets, though there are a variety of potential exemptions.

Deficits are solely allowed on the finish of the 12 months if precise income has fallen by $500 million or extra from the present budgeted quantity, if the province’s $1.5-billion contingency fund is exceeded attributable to disasters or emergencies, or if bills enhance underneath the Alberta Petrochemicals Incentive Program.

If such exemptions are met, the federal government has two years to return to steadiness.

Article content material

Commercial 4

Article content material

The plan additionally goals to restrict will increase in adjusted working bills on a year-over-year foundation, linking it to inhabitants progress and inflation charges. And it additionally limits in-year spending will increase and units guidelines for coping with funds surpluses.

A minimum of half of accessible surplus money from year-end outcomes should be earmarked to repay maturing debt.

The remaining needs to be put aside in a brand new Alberta fund and will later be directed to the Legacy Fund for financial savings, used to pay down extra debt, or for one-time initiatives that do not commit the federal government to everlasting spending will increase.

This might enable for some main spending commitments within the run-up to elections, corresponding to for main capital initiatives.

-

Alberta Finances 2023: See our full protection

-

Braid: Toews needs a funds invoice Alberta politicians by no means have any bother breaking

-

Alberta has a $2.4 billion surplus, with a rise in spending forward of the election

-

Learn Alberta Finance Minister Travis Toews’ funds speech

“We’re establishing the Alberta Fund to deliver self-discipline to using our surpluses,” Toews mentioned.

Commercial 5

Article content material

“It’s something however a slush fund . . . There are a sequence of controls that can deliver fiscal self-discipline to this – to any – authorities.”

Amendments can even be made to permit the Heritage Fund to retain all of its internet revenue.

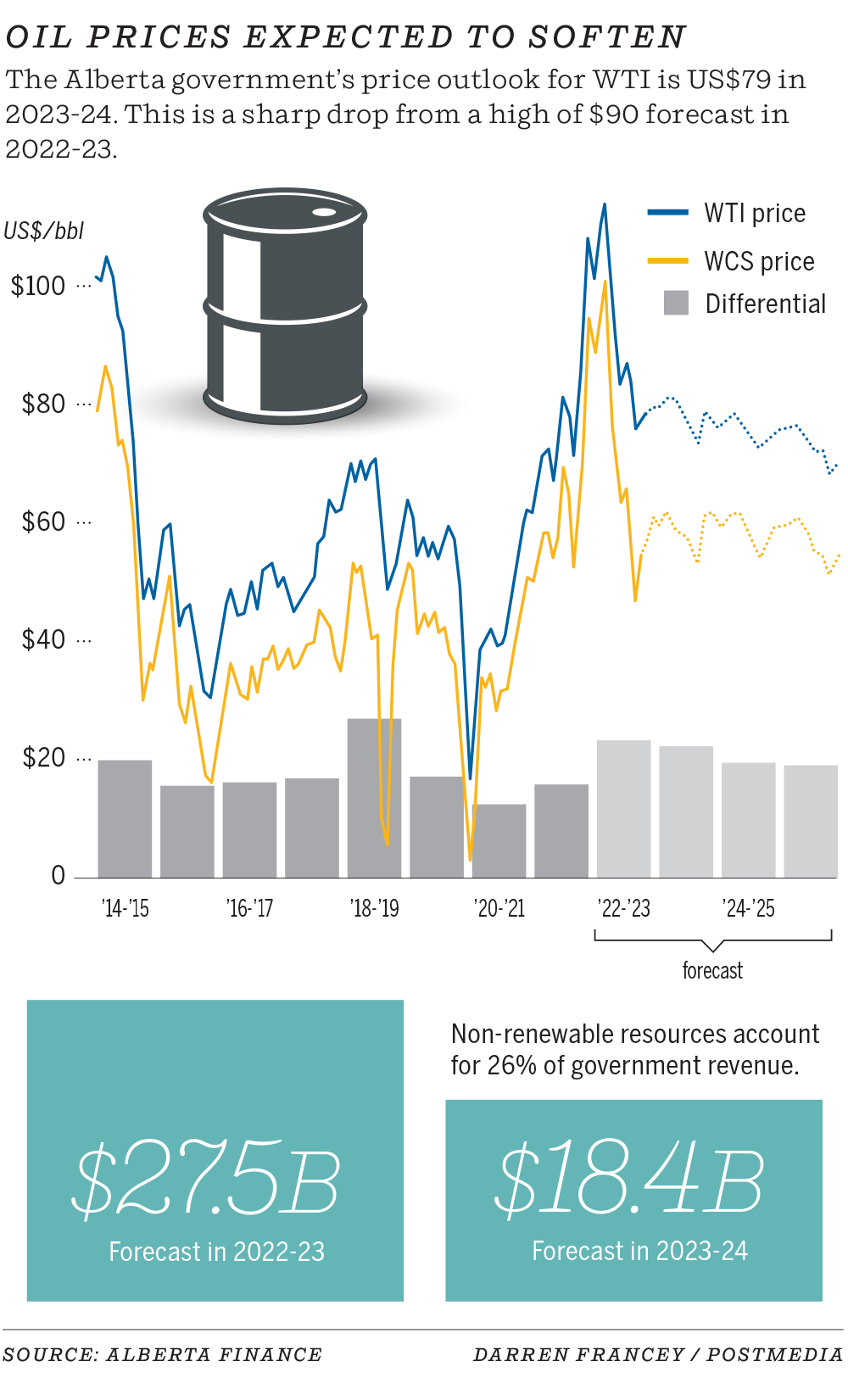

The federal government mentioned a part of the rationale for the monetary framework is because of the monumental fluctuations within the Alberta financial system and power revenues.

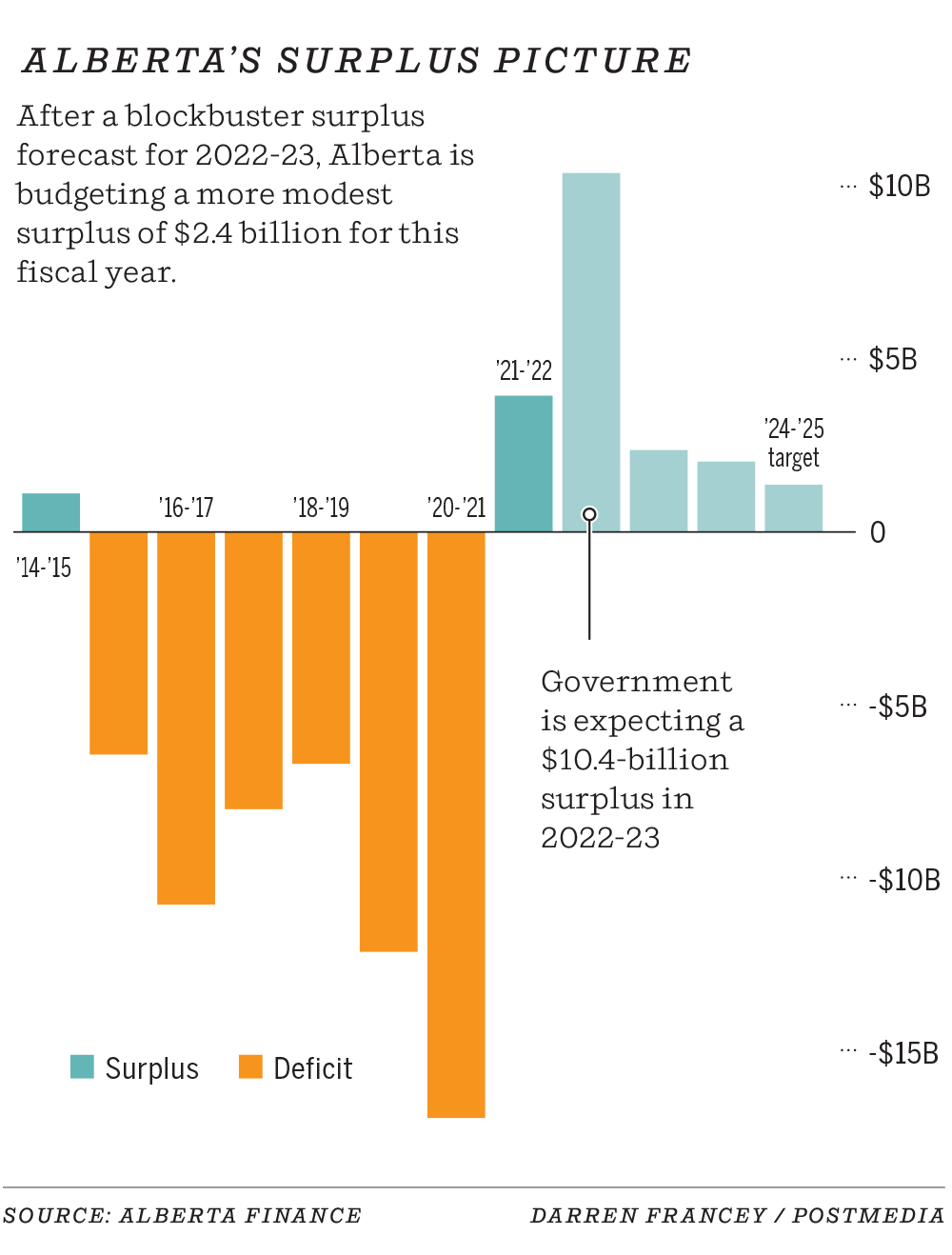

The excess within the new funds 12 months beginning in April is anticipated to fall to $2.4 billion, down from $10.4 billion for the present 12 months – and $3.9 billion reported in 2021-22.

Earlier than that, Alberta was hit by a monster deficit of $16.9 billion through the first 12 months of the pandemic, capping a streak of 12 deficits reported over 13 years.

For the approaching 12 months, the royal experience continues.

Commercial 6

Article content material

Whole authorities income is anticipated to fall by $5.4 billion to $70.7 billion, primarily attributable to a big decline in sources income, however offset by rising funding income.

The funds additionally reveals a reasonable slowdown within the province’s financial system after wild progress in 2022. Provincial GDP is anticipated to develop by 2.8 p.c this 12 months, after increasing by 4.8 p.c in 2022.

Benchmark oil costs are anticipated to say no from final 12 months’s degree of US$90.50 per barrel and common $79 per barrel in 2023-24, nonetheless a wholesome, worthwhile degree for the oil patch.

Whole taxpayer-backed debt is anticipated to fall to $79.7 billion by the tip of March, whereas the price of debt service is anticipated to achieve $2.8 billion within the coming 12 months.

Commercial 7

Article content material

Toews mentioned his choice proper now could be to repay debt, as that might create extra fiscal room for the province if it had been to hit one other financial shock.

However will the brand new guidelines work?

The Alberta Chambers of Commerce mentioned it has been calling for such measures for years and helps the concept of balanced budgets and limiting will increase in working bills.

“It is about that accountability and holding authorities accountable for the way they spend taxpayer {dollars},” mentioned Chamber CEO Shauna Feth.

“We’ll an election, so it is a good time to take this step in the fitting course.”

Nevertheless, College of Calgary economist Trevor Tombe mentioned the fiscal framework is complicated, whereas describing the projected funds surplus as “shameful.”

Commercial 8

Article content material

“The framework is absolutely attempting to market fiscal duty, however the authorities hasn’t actually modified their method to fiscal policymaking — aside from dramatically growing spending,” Tombe mentioned, noting that spending climbed to $68.3 billion within the new funds .

“It isn’t easy, it is not clear, and it’ll nearly actually be deserted by future governments.”

Chris Varcoe is a Calgary Herald columnist.

cvarcoe@postmedia.com

Commentary

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourages all readers to share their opinions on our articles. Feedback could take as much as an hour to seem on the location. We ask that you just preserve your feedback related and respectful. We have enabled e-mail notifications—you may now obtain an e-mail once you obtain a reply to your remark, there’s an replace to a remark thread you observe, or when a consumer you observe feedback. Go to our Group Pointers for extra info and particulars on learn how to regulate your e-mail settings.

Be a part of the dialog